Quinn, Lawmakers Still Working On Tax Hike

SPRINGFIELD, Ill. (CBS) -- Gov. Pat Quinn and legislative leaders in Springfield have been meeting repeatedly this week, trying to hammer out an agreement that would raise the state's income tax in an effort to solve a massive budget deficit.

But now, lawmakers are working on an 11th-hour solution in the waning days of the current General Assembly session.

CBS 2's Dana Kozlov reports that sources in Springfield have said a tax hike has been the subject of deep discussions for the past few days at the Illinois State Capitol, after lawmakers returned for a final lame-duck session before the new General Assembly is sworn in next week.

Quinn has long supported raising the state's personal income tax rate from 3 percent to 4 percent.

But an income tax hike could go even further. The Illinois Senate already has passed a proposal to raise the individual income tax rate from 3 percent to 5 percent, but it has stalled in the House.

LISTEN: Newsradio 780's Nancy Harty Reports

Podcast

If leaders reach an agreement on a specific tax hike to pitch to lawmakers, the General Assembly would likely vote soon. It could all happen before the new General Assembly is sworn in on Jan. 12.

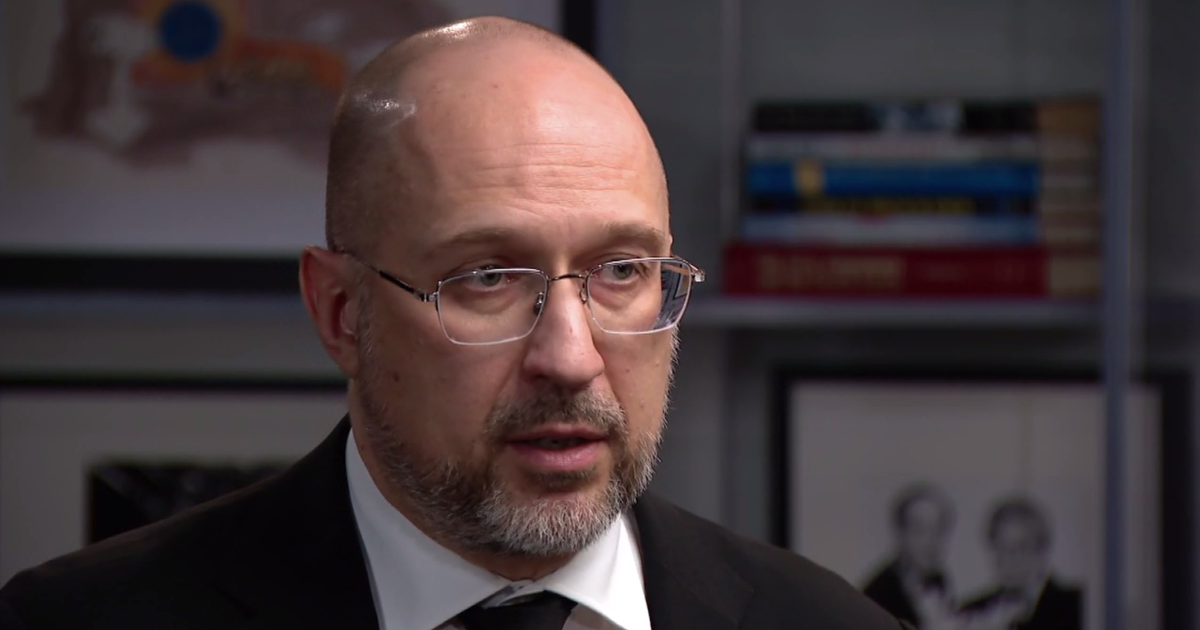

Political analyst Paul Green, a political science professor at Roosevelt University, said "if it's going to happen, it'll be done this week."

Gov. Pat Quinn, House Speaker Michael Madigan (D-Chicago), and state Senate President John Cullerton (D-Chicago) were among those who attended a meeting Tuesday to talk about raising the income tax rate anywhere from a half percentage point to two percentage points. Lawmakers were not going to vote on any tax plan on Wednesday, but Quinn, Madigan and Cullerton were still talking about a tax hike behind closed doors Wednesday evening.

Meantime, Springfield outsiders were warning that a tax hike alone won't solve the state's problems.

Laurence Msall, president of the Civic Federation, a government watchdog group, said, acknowledged the state's budget is in dire straits. But he said that, to do any good, a tax hike would need to be part of a longterm solution to state spending.

"What's the plan," he asks. "How is it going to be used? How is this money going to stabilize the state? How are we going to pay down the $6 billion in unpaid bills?"

Quinn has been pushing since last year for a one percentage point increase in the income tax to fund education. But he needs more votes from lawmakers to get it done and he needs the help of House Speaker Mike Madigan and Senate President John Cullerton to get it done.

The notion of a one- or two-percent tax hike isn't new and, to give some perspective, for someone making $50,000 a year, Quinn's plan would mean another $500 in taxes. The plan approved by the Illinois Senate in 2009 would mean an extra $1,000 in taxes.

If it helps, some taxpayers said they'd be willing to pay.

"Instead of thinking about, 'Well, how is this going to impact me?' I think all of us need to be thinking about what does Illinois need in the future and how all of us can actually be a part of that," taxpayer Delia Coleman said.

For two years, state lawmakers have been unable to come up with a solution to the state's budget crisis. Now they're planning to try and hammer out a deal in about a week.

However, some voters say it's about time, even if that means raising income taxes.

"It needs to be done to raise the revenues we need to get out of the hole," said Roxanne Rochester of Chicago.

As CBS 2's Mike Puccinelli reports, the Illinois budget mess has become so severe that some experts say bond buyers should no longer invest in the state's debt for fear that the state will default.

The budget hole stands at $13 billion, and filling it will inevitably cause some pain.

"That sucks when you're paying more taxes," said Poe Merley of Chicago.

But right now, some analysts say the state is spending $3 for every $2 it takes in. Thus, an income tax is being discussed.

"They can raise it, but I want to see what they're going to do with the cuts," said Eric McMiller of Chicago. "We can't just raise it without looking at some cuts, so let's see what they're going to cut."

Joseph Brickman says he's a small-government, low-taxes kind of guy, but even he is resigned to paying more taxes.

"Clearly we're in a critical situation financially," Brickman said, "and it pains me because Chicago is a great city.

But Chicago is also a city in a state that some experts say is in the worst financial condition in the country, with $6 billion owed to state service providers right now.

"I think it's clear evidence of mismanagement," Rochester said.

An analyst with the conservative Illinois Policy Institute said that a tax hike under any circumstance is a bad idea, adding when you take money out of people's wallets, it pushes people – and ultimately jobs – out of the state.

In May 2009 -- during the early part of the current legislative session -- Senate Democrats approved the tax hike proposal.

The Illinois House has yet to vote on that measure, and in the time since, the state's budget hole has continued to balloon.

Passage of the tax deal seems more likely now, since the election is over, and lawmakers are unlikely to be held accountable for two years before voters next cast their ballots.