Governor Offers Illinois Business An 'Escape To Wisconsin'

CHICAGO (WBBM) -- Within hours of the Illinois legislature's vote to increase the business tax, the new Republican governor in Wisconsin wasted no time in trying to lure Illinois businesses across the border.

Right now, even with the corporate income tax rising to 7 percent in Illinois, Wisconsin's corporate tax is still slightly higher -- at nearly 8 percent.

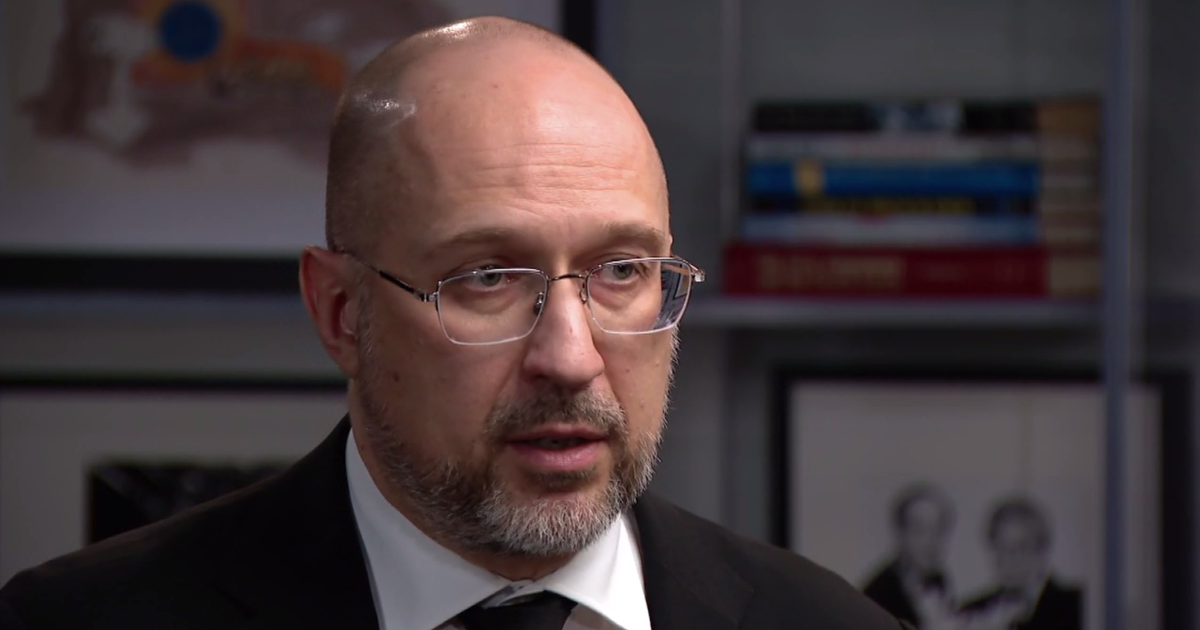

That's going to change within the first few weeks of Wisconsin Gov. Scott Walker's administration.

LISTEN: Newsradio 780's Regine Schlesinger Reports

Podcast

"Back in the mid-80s, Wisconsin used to have a great tourism slogan called 'Escape to Wisconsin'--trying to draw folks up from Chicago and Illinois." Walker said. "We are going to renew that slogan except in this case for job creators."

Walker says the GOP majority in the Wisconsin statehouse means he'll move to cut taxes to attract businesses from across the border and create more jobs.

"It's a great contrast," Walker said. "It's one in which we are going to start recruiting in Chicago and Rockford and all over Illinois. I think it's a stark message."

While Illinois charges an additional "Personal Property Replacement Tax" of 2.5 percent of income on top of the corporate income tax, Wisconsin charges a state property tax that Illinois doesn't have.

Wisconsin's individual income tax rate also is higher for most taxpayers than in Illinois.

Wisconsin has a graduated income tax rate that starts at 4.6 percent for taxpayers earning less than $10,070 a year. For those that make up to about $20,000 a year, it jumps to 6.15 percent. The rate ranges between 6.5 percent and 7.75 percent for higher incomes in Wisconsin.

Earlier this week, Indiana Gov. Mitch Daniels also touted his state as the place to go for Illinois' businesses and families, who will see their personal income tax rate increase from 3 percent to 5 percent.

"We already had an edge on Illinois in terms of the cost of doing business, and this is going to make it significantly wider," Daniels, a Republican, told the Herald-Review on Monday.

In Indiana, while it has a lower income tax rate than Illinois at 3.4 percent, individual counties are allowed to impose their own income taxes, some of which are as high as 3 percentage points.

And Indiana's corporate income tax isn't much different than Illinois. Indiana's corporate income tax rate is 8.5 percent, plus any local income taxes. In Illinois, the corporate income tax rate is 7 percent, plus the 2.5 percent "Personal Property Replacement Tax."