Study: Local Government Pension Debt At More Than $27 Billion

CHICAGO (CBS) -- The Chicago area's pension programs for government employees are underfunded by a whopping $27.4 billion, according to a new report from a local watchdog group.

The Civic Federation says several factors contribute to the massive problem.

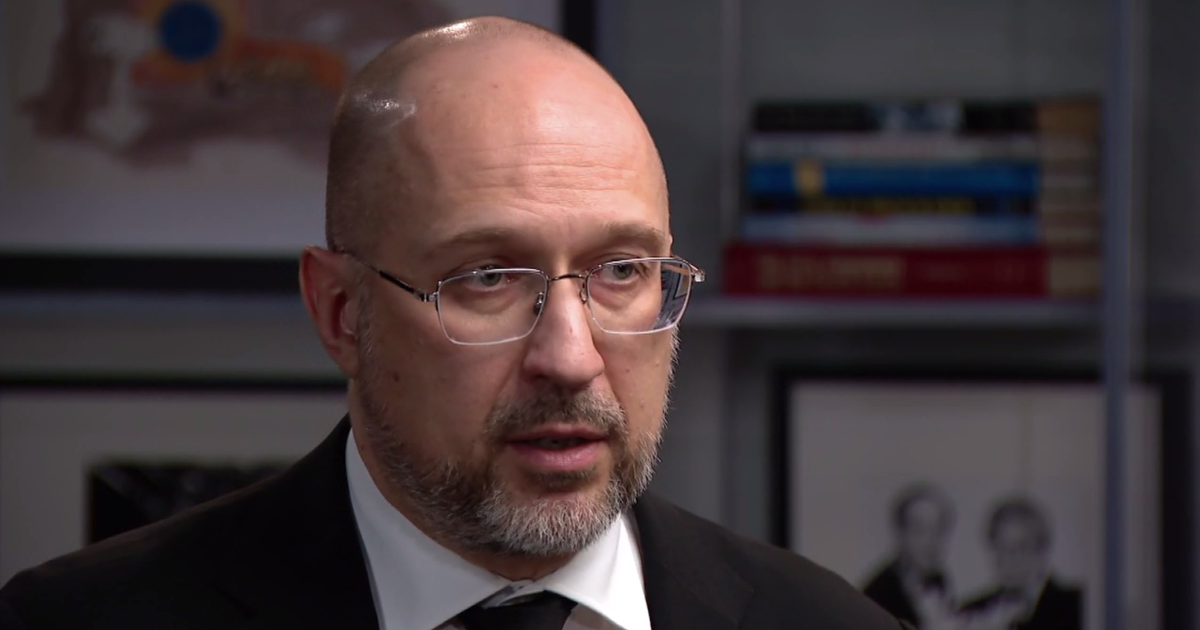

"For years the local governments were contributing less than the actuaries report is the cost of the program," explained Civic Federation President Laurence Msall.

LISTEN: WBBM Newsradio's Brandis Friedman reports

Podcast

Other factors: "Like everyone else involved in the stock market, the pension funds saw loss of investments over the last few years," he said.

Msall also said the ratio of working government employees to pension beneficiaries is heading in the wrong direction.

"We have more people taking out of the pension programs, and less people paying into them," he said.

Msall said the annual study looked at 10 pension programs, affecting 123,000 employees and 100,000 retirees, including the city of Chicago, Cook County government, Chicago Public Schools, Chicago Park District, Chicago Transit Authority, Cook County Forest Preserve District, and Metropolitan Water Reclamation District of Greater Chicago.

The report presents several solutions to help the mayor, county board president, union leaders, and lawmakers stabilize the pension program.

"We also have to get real in terms of reducing the cost of these programs, even with the benefit changes reducing the automatic increase," Msall said.

He explained employees who've been retired for a year automatically receive a compounded three-percent annual increase -- which, over 17 years, can double a retirement benefit.

"That has an enormous cost," he said.

Msall also said Gov. Pat Quinn's proposal to increase the retirement age to 67 and require state employees to contribute more to their pensions are also part of the solution -- and the group is calling on elected officials and unions to take action.