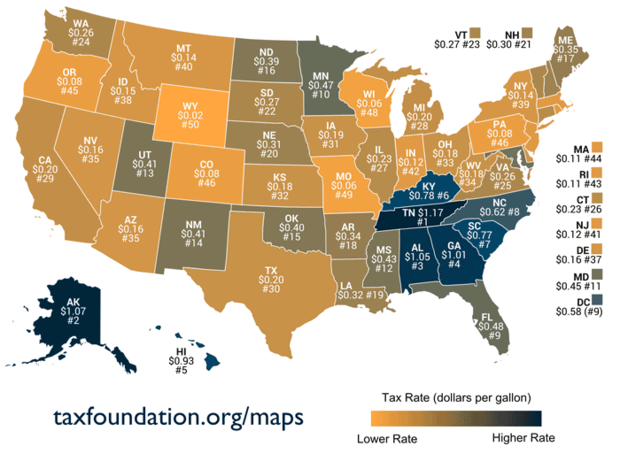

By Far, Illinois Has Highest Beer Tax Among Neighboring States

By John Dodge

CHICAGO (CBS) -- Illinois beer drinkers pay far more in excise taxes that its neighbors, according to a state-by-state breakdown.

The tax is imposed on businesses that are manufacturers or importing distributors of beer. Of course, that means that ultimately the consumer pays for it.

In Illinois, the tax is 23 cents per gallon of beer, according to the Tax Foundation. It is far less in beer-loving states like Missouri and Wisconsin (both at six cents).

In Indiana, the tax (12 cents) is half of the Illinois tax. Chicagoans have been known to hop the border to take advantage of lower taxes on gasoline and tobacco. It appears one could add six-packs to that errand list, too.

In fact, Missouri, Wisconsin and Indiana rank among the top 10 cheapest tax rates in the country.

Only Wyoming is cheaper than the Show-Me and Badger states. Indiana rates at No. 8.

Iowa and Michigan are higher at 19 cents and 20 cents.

Kentucky, which shares a far southern border with Illinois, has one of the highest beer taxes in the nation at 78 cents.

Just to the south, Tennessee has the highest tax in the nation at $1.17.

In a continuing search for revenue, the budget-challenged state of Illinois last increased the tax in 2009.

The tax ranks No. 23 in the country.