Centers Offer Free Help For Low And Moderate Income Taxpayers

(CBS) -- Tax filing season is here and once again, the city and a pair of non-profit groups are preparing returns for low- and moderate-income taxpayers for free, reports WBBM's Bob Roberts.

If you're single and earning up to $25,000 a year or in a family whose total earnings don't exceed $50,000, you qualify for free tax prep.

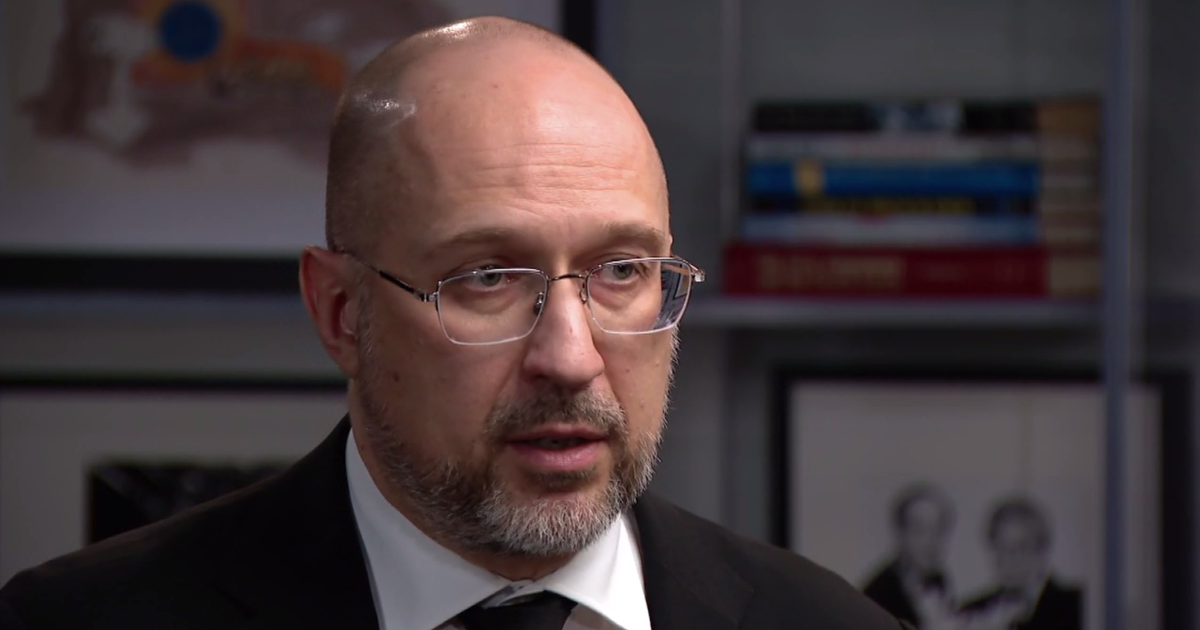

Center for Economic Progress CEO David Marzahl says it can be the difference between poverty and paying the bills.

"Some refunds will be very small but especially for those families with children, because of the child tax credit and the earned income tax credit, many refunds might be two, three, four thousand dollars," Marzahl says.

Podcast

Mayor Rahm Emanuel says taxpayers should take advantage of the free help and claim every deduction and tax credit they can.

"Nobody should leave five hundred dollars, a thousand dollars, two thousand dollars, four thousand dollars on the table when it's your money," Emanuel says. "Trust me, the corporations got accountants scouring the tax code to figure out every deduction. It's important that we make sure the working families get that same deduction."

There are 21 sites in the city and six in the suburbs, all listed on TaxPrepChicago.org. Bring your W2, Social Security card, a photo ID and any documents that can help preparers including property tax bills, records of college-related expenses and last year's returns.