Protesters demand firing of CPD officers involved in Dexter Reed shooting

Police body camera footage shows police shooting at Reed 96 times in 41 seconds by a CPD tactical team.

Watch CBS News

Police body camera footage shows police shooting at Reed 96 times in 41 seconds by a CPD tactical team.

Two trains' runs from LaSalle Street station to Joliet were canceled Thursday night because of the incident.

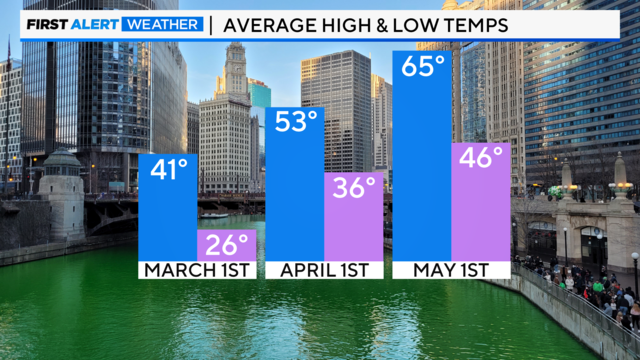

The expectation has been that they will appear sometime in May or early June, according to Ken Johnson, a horticulture educator at the University of Illinois.

Israel launched at least one missile strike at Iran early Friday morning, U.S. officials confirmed to CBS News, in apparent retaliation for last weekend's drone and missile attack.

Café Selmarie, 4721 N. Lincoln Ave., first announced its plans to close in September. Owner Birgit Kobayashi is set to retire.

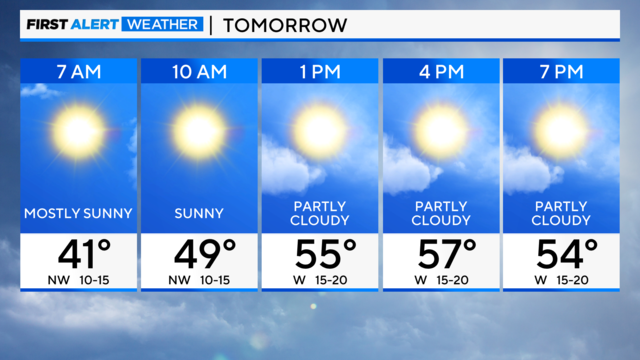

Other than a few rumbles of thunder and brief downpours, the severe weather risk is expected to remain south of the Chicago area.

The shots were reported at 4:01 p.m. on southbound I-294 near the 88th Avenue overpass in Justice.

Uber is rolling out a new safety feature which would allow riders to verify their own identify and connect to an official ID, but it doesn't require riders to do so.

Breaking News, First Alert Weather, Exclusive Investigations & Community Journalism

Other than a few rumbles of thunder and brief downpours, the severe weather risk is expected to remain south of the Chicago area.

CBS 2 News Chicago's weather forecast model — First Alert — helps digital users and traditional television viewers stay on top of Chicago's dynamic weather.

The emergence of greenery and blossoms is underway soon as El Niño fades away, and we transition to a neutral weather pattern.

Anthony Robinson's attorney said his previous defense lawyer failed to present evidence that showed it was physically impossible for him to be the shooter.

The village board is working on a resolution to hire Lightfoot, a former federal prosecutor before her lone term as Chicago's mayor, to investigate claims Henyard has been misusing public funds.

DCFS Director Heidi Mueller was asked Thursday why some kids in the system are being held in psychiatric hospitals longer than medically necessary.

One resident told CBS 2 she now lives in fear, as many of the recent armed robberies happened within blocks of her home. CBS 2's Marybel Gonzalez reports.

Protesters gathered Thursday night ahead of a Police Board meeting, taking issue with the police shooting that killed Dexter Reed last month. CBS 2's' Charlie De Mar reports.

The body of a woman who had been shot and killed, and the body of a man who had shot and killed himself with the same gun, were found in a motel in Lemont.

Two Rock Island District trains were canceled after the incident in Robbins.

A Joliet mother has been charged after her 12-year-old daughter died of an apparent heroin and fentanyl overdose, police said Thursday. Colette Bancroft, 35, currently faces a charge of drug possession.

Fans started an online petition calling for the games to be moved from Wintrust Arena to the United Center.

Caruso reportedly suffered a 'significant' right foot sprain in Chicago's win against the Hawks on Wednesday.

White, whose previous high was 37, went hard at the rim throughout the game and had fans chanting his name down the stretch.

His abrupt departure left many questioning what happened and why so suddenly.

The company SleepOnLatex makes eco-friendly mattresses and just launched a new brand called "Earthfoam."

The process of helping former felons who have turned their lives around get a fresh start and find work often starts with getting criminal records expunged.

Israel launched at least one missile strike at Iran early Friday morning, U.S. officials confirmed to CBS News, in apparent retaliation for last weekend's drone and missile attack.

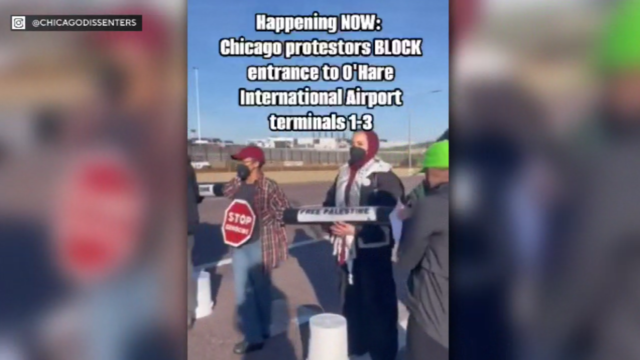

Rep. Dan Ugaste (R-Geneva) has proposed making it a felony to block an "exceptionally busy public right of way" for 5 minutes or longer.

Police arrested more than 100 people at Columbia University on Thursday at a makeshift encampment set up by pro-Palestinian protesters on the university's main lawn.

Ald. Timmy Knudsen (43rd) introduced the "Stop Hate Littering Ordinance" after a wave of antisemitic flyers popped up on cars in Lincoln Park in February and April.

The Supreme Court will consider Monday whether bans on public camping constitute "cruel and unusual punishment" barred by the Eighth Amendment.

The Better Business Bureau warns that anyone buying an event ticket should watch out for fake ticket scams.

Financial records show Paul Croft and J.D. Frost raised about $30 million for a hydrogen plant that was supposed to be, at one point, in Indiana. It never existed, an attorney says.

Anyone with these sausages in their refrigerators should throw them away or return them to the store.

Elliott Henderson, of south suburban Glenwood, is featured on a website, a petition, and Facebook and Instagram pages -- all dedicated to warning others about his travel deals.

It all stems from the cars being easier targets for thieves because of their design.

The department said anyone who visited the Sam's Club at 9400 S. Western Ave. in Evergreen Park one day last week may have been exposed to someone with measles.

Health officials are warning consumers not to consume the Infinite Herbs basil sold at Trader Joe's after 12 people were sickened.

Officials said there was no known link between this case and the recent outbreak of measles at a migrant shelter in Chicago.

Health department officials said the case does not appear to be linked to new migrant arrival shelters in Chicago, and the source of infection is unknown.

The fake dentist also faces accusations of practicing while unlicensed in Nevada and was even arrested before treating patients in the Chicago suburbs.

Café Selmarie, 4721 N. Lincoln Ave., first announced its plans to close in September. Owner Birgit Kobayashi is set to retire.

Right now, Illinois sports books pay 15% tax on their revenue. But Gov. JB Pritzker's latest budget proposal would spike the tax to 35%.

Currently, a pair of two-story vintage buildings occupy the space.

Quinn has filed an ordinance with the Chicago city clerk that would ask the City Council to put a referendum on the November ballot allowing voters to decide if their tax dollars should support new stadiums.

The Lincoln Square standby, at 4721 N. Lincoln Ave., first announced its plans to close in September.

Taylor Swift took to social media hours ahead of the expected release of her new album "The Tortured Poets Department."

Guitar legend Dickey Betts, who co-founded the Allman Brothers Band and wrote their biggest hit, "Ramblin' Man," has died.

Colbert lived in Chicago for 11 years, performing and "cutting his comedy teeth" at the legendary Second City and attending Northwestern University. His show will broadcast from Chicago's storied Auditorium Theater Aug. 19-22 on CBS.

The mural was unveiled on the side of the building at the southeast corner the Chicago Medical Society building at Grand Avenue Dearborn Street.

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

One resident told CBS 2 she now lives in fear, as many of the recent armed robberies happened within blocks of her home. CBS 2's Marybel Gonzalez reports.

Protesters gathered Thursday night ahead of a Police Board meeting, taking issue with the police shooting that killed Dexter Reed last month. CBS 2's' Charlie De Mar reports.

The body of a woman who had been shot and killed, and the body of a man who had shot and killed himself with the same gun, were found in a motel in Lemont.

Two Rock Island District trains were canceled after the incident in Robbins.

A Joliet mother has been charged after her 12-year-old daughter died of an apparent heroin and fentanyl overdose, police said Thursday. Colette Bancroft, 35, currently faces a charge of drug possession.

Police body camera footage shows police shooting at Reed 96 times in 41 seconds by a CPD tactical team.

Two trains' runs from LaSalle Street station to Joliet were canceled Thursday night because of the incident.

The expectation has been that they will appear sometime in May or early June, according to Ken Johnson, a horticulture educator at the University of Illinois.

Israel launched at least one missile strike at Iran early Friday morning, U.S. officials confirmed to CBS News, in apparent retaliation for last weekend's drone and missile attack.

Café Selmarie, 4721 N. Lincoln Ave., first announced its plans to close in September. Owner Birgit Kobayashi is set to retire.

Anthony Robinson's attorney said his previous defense lawyer failed to present evidence that showed it was physically impossible for him to be the shooter.

The village board is working on a resolution to hire Lightfoot, a former federal prosecutor before her lone term as Chicago's mayor, to investigate claims Henyard has been misusing public funds.

DCFS Director Heidi Mueller was asked Thursday why some kids in the system are being held in psychiatric hospitals longer than medically necessary.

CBS 2 discovered the woman, Whitley Temple, was hired by the City of Chicago while awaiting trial.

Whitley Temple pleaded not guilty to the charges — and after nearly two years of delays, the case goes before a Cook County judge for trial on Monday.

Fans started an online petition calling for the games to be moved from Wintrust Arena to the United Center.

Caruso reportedly suffered a 'significant' right foot sprain in Chicago's win against the Hawks on Wednesday.

White, whose previous high was 37, went hard at the rim throughout the game and had fans chanting his name down the stretch.

Gavin Sheets homered, Erick Fedde pitched scoreless ball into the sixth inning and the struggling Chicago White Sox edged the Kansas City Royals 2-1 for a doubleheader split that ended a six-game slide.

Some fans may be surprised to see WNBA players' starting base pay under $80,000, but why is the league structured like this?

The shots were reported at 4:01 p.m. on southbound I-294 near the 88th Avenue overpass in Justice.

A motive was not known as of late Thursday, and police have not established a relationship between Crane and the woman.

University police were ramping up patrols, and students said other new resources in place help make them feel a bit better.

The same man is suspected in both robberies. Police said he made a verbal demand for funds while showing a handgun.

Collette Bancroft, 35, currently faces a charge of drug possession.