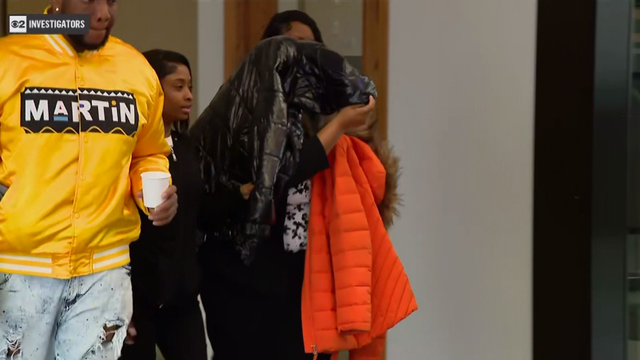

Police release video of man wanted in murder of Chicago Police Officer Luis Huesca

Huesca was off duty, but in uniform, at the time of the shooting.

Watch CBS News

Huesca was off duty, but in uniform, at the time of the shooting.

The closure affects both Dom's locations in Chicago, and all 33 Foxtrot stores in Chicago, Texas, and the Washington D.C. area.

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

The course is free, but registration is required.

Two boys were shot as a large group of teens flooded the streets in the South Loop near Roosevelt and Canal on March 2.

Walter Payton College Preparatory High School was listed as the 5th best high school with a 100% graduation rate.

Riders should expect some trains and platforms to be busier than usual as normal service is restored.

Police said the man grabbed a 25-year-old woman, in the 700 block of West Brompton Avenue, and threatened her with a gun.

Breaking News, First Alert Weather, Exclusive Investigations & Community Journalism

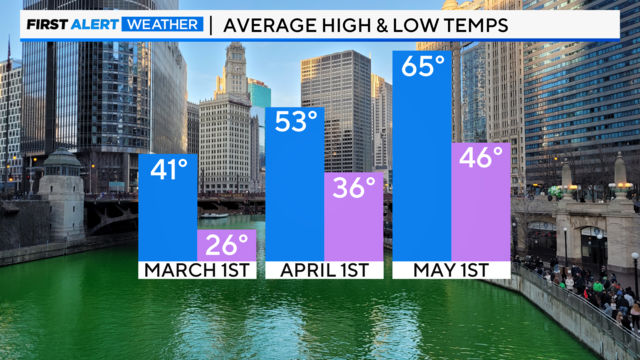

There is a low potential for severe weather, but some could be strong with gusty wind.

CBS 2 News Chicago's weather forecast model — First Alert — helps digital users and traditional television viewers stay on top of Chicago's dynamic weather.

The emergence of greenery and blossoms is underway soon as El Niño fades away, and we transition to a neutral weather pattern.

Police arrived at the scene sooner than if they had waited for the first 911 call.

Anthony Robinson's attorney said his previous defense lawyer failed to present evidence that showed it was physically impossible for him to be the shooter.

The village board is working on a resolution to hire Lightfoot, a former federal prosecutor before her lone term as Chicago's mayor, to investigate claims Henyard has been misusing public funds.

CBS 2 Meteorologist David Yeomans has the latest forecast.

Chicago police have released video of a person they say is wanted in connection to the killing of Officer Luis Huesca. Police did not call the man a suspect, instead they were looking to identify him in connection with the shooting. But police did say he should be considered armed and dangerous.

Chicago police are warning residents after a man attempted to sexually assault two women in Chicago's Lakeview neighborhood.

After almost three years after the killing of Chicago police officer Ella French, her memory lives on through a scholarship.

Climate change is threatening extinction for piping plovers. A local group is working to protect them.

Danny Mendick had two hits, and Gavin Sheets and manager Pedro Grifol were ejected for arguing balls and strikes in the eighth inning.

The team is planning to hold a press conference with city officials on Wednesday to unveil their plans for a new publicly-owned stadium on the Museum Campus.

Josh Melnick and Chris Terry each scored, and Hudson Elynuik had two assists

City data show crime is down in the Austin community since Sandie Norman set up her ministry at Madison and Central.

ChiTown Muslimah Athletics is a women's Muslim athletics group for women 23 and over.

His abrupt departure left many questioning what happened and why so suddenly.

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

Police arrived at the scene sooner than if they had waited for the first 911 call.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

The Supreme Court considered whether efforts to address homelessness in Grants Pass, Oregon, violated the Constitution's prohibition on cruel and unusual punishment.

Jurors in former President Donald Trump's criminal trial in New York got their first glimpse of the arguments both sides plan to make.

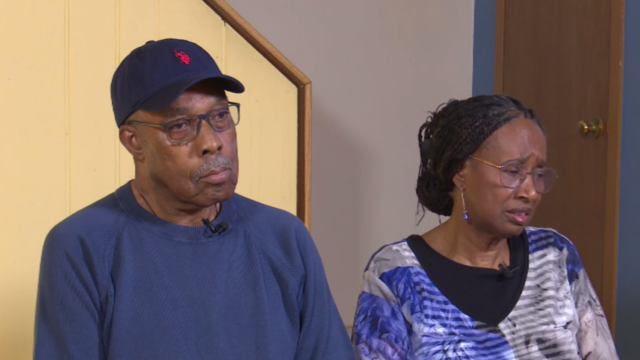

The family didn't get their cut of the estate sale, not hearing back from the salesman until CBS 2 got involved.

The Better Business Bureau warns that anyone buying an event ticket should watch out for fake ticket scams.

Financial records show Paul Croft and J.D. Frost raised about $30 million for a hydrogen plant that was supposed to be, at one point, in Indiana. It never existed, an attorney says.

Anyone with these sausages in their refrigerators should throw them away or return them to the store.

Elliott Henderson, of south suburban Glenwood, is featured on a website, a petition, and Facebook and Instagram pages -- all dedicated to warning others about his travel deals.

The city's measles dashboard said a total of 63 measles cases have been confirmed in Chicago this year, with one new case this week.

The department said anyone who visited the Sam's Club at 9400 S. Western Ave. in Evergreen Park one day last week may have been exposed to someone with measles.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Officials said there was no known link between this case and the recent outbreak of measles at a migrant shelter in Chicago.

Health department officials said the case does not appear to be linked to new migrant arrival shelters in Chicago, and the source of infection is unknown.

Café Selmarie, 4721 N. Lincoln Ave., first announced its plans to close in September. Owner Birgit Kobayashi is set to retire.

Right now, Illinois sports books pay 15% tax on their revenue. But Gov. JB Pritzker's latest budget proposal would spike the tax to 35%.

Currently, a pair of two-story vintage buildings occupy the space.

Quinn has filed an ordinance with the Chicago city clerk that would ask the City Council to put a referendum on the November ballot allowing voters to decide if their tax dollars should support new stadiums.

The Lincoln Square standby, at 4721 N. Lincoln Ave., first announced its plans to close in September.

The singer was found deceased at her home, a representative said.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

Guitar legend Dickey Betts, who co-founded the Allman Brothers Band and wrote their biggest hit, "Ramblin' Man," has died.

Colbert lived in Chicago for 11 years, performing and "cutting his comedy teeth" at the legendary Second City and attending Northwestern University. His show will broadcast from Chicago's storied Auditorium Theater Aug. 19-22 on CBS.

The mural was unveiled on the side of the building at the southeast corner the Chicago Medical Society building at Grand Avenue Dearborn Street.

CBS 2 Meteorologist David Yeomans has the latest forecast.

Chicago police have released video of a person they say is wanted in connection to the killing of Officer Luis Huesca. Police did not call the man a suspect, instead they were looking to identify him in connection with the shooting. But police did say he should be considered armed and dangerous.

Chicago police are warning residents after a man attempted to sexually assault two women in Chicago's Lakeview neighborhood.

After almost three years after the killing of Chicago police officer Ella French, her memory lives on through a scholarship.

Climate change is threatening extinction for piping plovers. A local group is working to protect them.

Huesca was off duty, but in uniform, at the time of the shooting.

The closure affects both Dom's locations in Chicago, and all 33 Foxtrot stores in Chicago, Texas, and the Washington D.C. area.

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

The course is free, but registration is required.

Two boys were shot as a large group of teens flooded the streets in the South Loop near Roosevelt and Canal on March 2.

Police arrived at the scene sooner than if they had waited for the first 911 call.

Anthony Robinson's attorney said his previous defense lawyer failed to present evidence that showed it was physically impossible for him to be the shooter.

The village board is working on a resolution to hire Lightfoot, a former federal prosecutor before her lone term as Chicago's mayor, to investigate claims Henyard has been misusing public funds.

DCFS Director Heidi Mueller was asked Thursday why some kids in the system are being held in psychiatric hospitals longer than medically necessary.

CBS 2 discovered the woman, Whitley Temple, was hired by the City of Chicago while awaiting trial.

Danny Mendick had two hits, and Gavin Sheets and manager Pedro Grifol were ejected for arguing balls and strikes in the eighth inning.

The team is planning to hold a press conference with city officials on Wednesday to unveil their plans for a new publicly-owned stadium on the Museum Campus.

Josh Melnick and Chris Terry each scored, and Hudson Elynuik had two assists

White started 78 games and averaged just over 19 points per contest, up from 9.7 a season ago.

Nico Hoerner had three hits and two RBIs for the Cubs, and Mike Tauchman had two hits and scored twice.

Two boys were shot as a large group of teens flooded the streets in the South Loop near Roosevelt and Canal on March 2.

Sandra Kolalou was convicted in the death of 69-year-old Frances Walker.

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

Police arrived at the scene sooner than if they had waited for the first 911 call.

Huesca was off duty, but in uniform, at the time of the shooting.