N.J. Latest State Trying To Take Illinois Jobs

CHICAGO (CBS) -- Here we go again. Yet another state is trying to siphon off Illinois businesses and jobs, after state lawmakers here imposed a controversial income tax hike on individuals and companies.

Competition flared recently between Illinois and two of its neighbors, Wisconsin and Indiana, whose leaders claim their respective environments are friendlier to commerce.

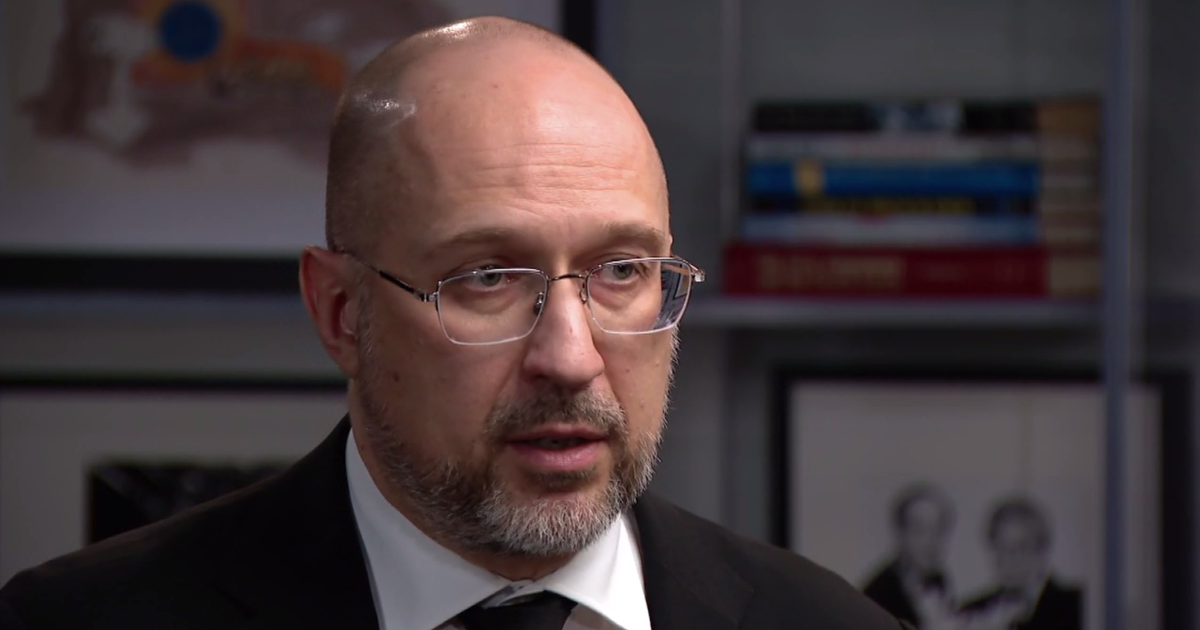

Now, New Jersey Gov. Chris Christie's administration is casting lures to Illinois businesses that may be soured on the Land of Lincoln.

LISTEN: Newsradio 780's Lisa Fielding reports

Podcast

The Republican governor is launching an ad campaign encouraging them to relocate to the Garden State. An official announcement from the Christie administration is planned for Tuesday, when ads will start appearing in newspapers and on radio stations in major Illinois cities like Chicago and Springfield.

Print and radio ads reiterate Christie's commitment not to raise taxes.

"The job creators of our country are mobile, and they are looking for a climate that provides the certainty and stability that comes with a fiscally responsible government that manages its budgets accordingly," Christie said. "In New Jersey, we mean business.

Christie campaigned for GOP gubernatorial candidate Bill Brady, who lost the election to Democrat Pat Quinn. The winner inherited a budget shortfall equal to roughly half its general fund revenue, so Quinn has raised personal income taxes to 5 percent from 3 percent, and corporate business taxes to 9.5 percent from 7.3 percent.

That makes Illinois' business tax rate higher than New Jersey's 9 percent for businesses with incomes over $100,000. But its personal income tax rate remains lower: New Jersey's rate is 6.37 percent for couples earning more than $150,000 a year and 8.7 percent for those earning more than $500,000 a year.

The cost of the ad campaign wasn't immediately available.

The ads follow a personal appeal from Lt. Gov. Kim Guadagno, who sent letters to 553 Illinois-based companies large and small that will be affected by the tax increases.

Christie himself appears in the ads, pledging to hold the line on taxes and promote growth through job-friendly policies.

Christie spokeswoman Maria Comella said the campaign shows that the governor intends to be hands-on about attracting businesses and jobs to New Jersey.

This is a markedly different approach for a New Jersey governor, she said, and keeps a campaign promise from Christie that he would be the state's marketer-in-chief and biggest advocate to business to capture every opportunity.

But Christie is doing more than seizing a potential business opportunity. He's trying to begin turning around New Jersey's reputation as an unfriendly place for businesses. The Tax Foundation, a nonprofit research organization, has ranked New Jersey worst or nearly worst among the 50 states regarding the tax environment for businesses for the past several years.

Contributing: Associated Press