NAACP To Teach Homeowners About Foreclosure Rights

CHICAGO (CBS) -- A local branch of the NAACP wants to make sure homeowners know their rights when it comes to foreclosure.

CBS 2's Suzanne Le Mignot has the story of a woman who went to the organization for help and in turn, could be paving the way to make a difference for others.

Sarah Garner, who is facing foreclosure, said her house has "meant everything. I've raised my children here in the neighborhood. Everything was so nice."

Garner has lived in her Washington Heights home for more than four decades. Now, after her husband's death and missed mortgage payments, Garner was recently served with a judgment for foreclosure and sale. The plaintiff on the judgment is Clearvue Opportunity XII LLC.

"I never even heard of this Clearvue or whatever, I never heard of them yet," Garner said.

Her loan was sold to a number of loan service companies and now she's in foreclosure.

The foreclosure and sale judgment means Garner's home could be auctioned off in 90 days.

"I wanted to talk to somebody, but I didn't know who to talk to about it," she said.

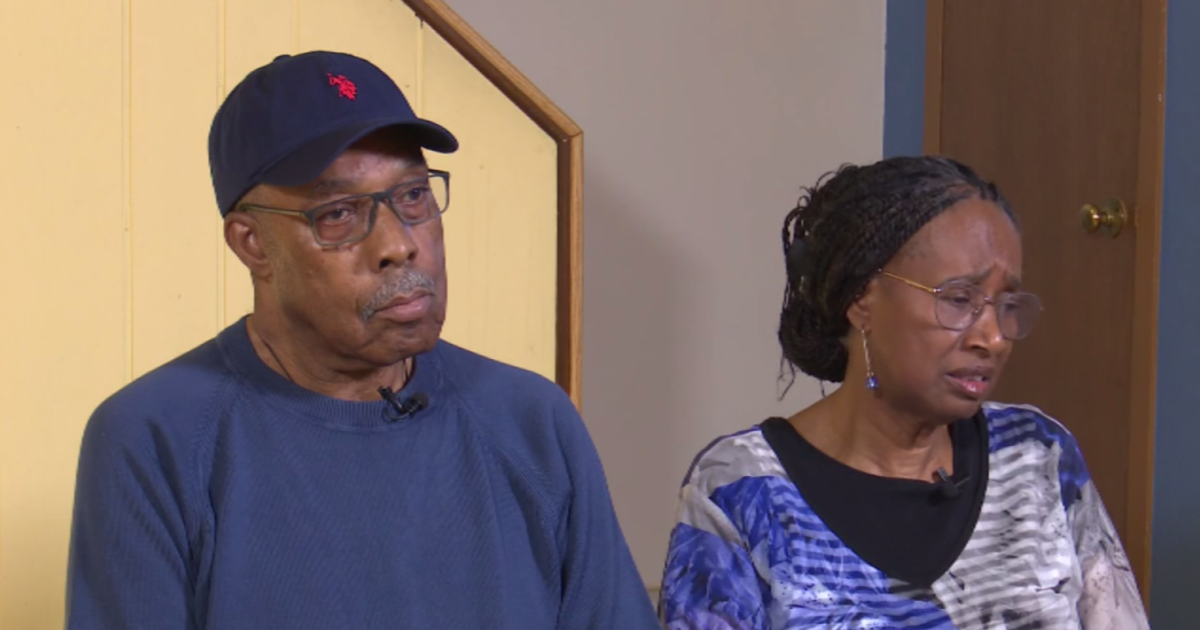

The 77-year-old got in touch with the NAACP Chicago Far South Suburban Branch for help.

David Lowery, president of NAACP CFSSB said, "I decided to reach out for our attorneys and get with them so that we can assist her and get her out of this mess."

Real estate attorney Ernest Fenton is working with the NAACP branch. Fenton says Garner's situation is not uncommon.

"What happens is that, in light of what's happening in the market, banks are selling their rights to notes and mortgages; and, so, they're being transferred from bank to bank," Fenton said.

Asked what recourse Garner might have in light of the foreclosure and sale judgment on her house, Fenton said, "Fortunately she has recourse. I mean, the law says that you have 30 days from the date of judgment to ask that it be vacated."

"Typically, in court, the judge will vacated it if it's done within 30 days and you can also have it vacated after 30 days," Fenton added. "This is something everyone should know too; that you can still obtain a loan modification, even after a judgment."

He also said that, if a homeowner submits a loan modification seven days before a foreclosure sale, the sale should be stayed or stopped so the homeowner can work on the loan modification and have a chance to fight the foreclosure.

Garner said, "My hope is that … I could salvage the home, because I've been here so long and have put so much into it. … I want to live the rest of my life here."

The NAACP branch said cases like Garner's have led them to consider bringing a class action lawsuit against banks and their agents carrying foreclosures with shoddy or falsified paperwork.

Last year, Illinois Attorney General Lisa Madigan joined a nationwide investigation questioning the banks' paperwork. Clearvue Opportunity XII LLC did not return calls for comment.