After Fraudsters Racked Up $6,000 On Stolen Credit Card, HSBC Demanded Victim Pay Up, Despite 'Zero Liability' Promise

CHICAGO (CBS) -- Like many banks, HSBC boasts of their vast fraud protection: zero dollar liability. Yet they came after Elanor Leskiw, of Chicago, for $6,000 in purchases she says she never made.

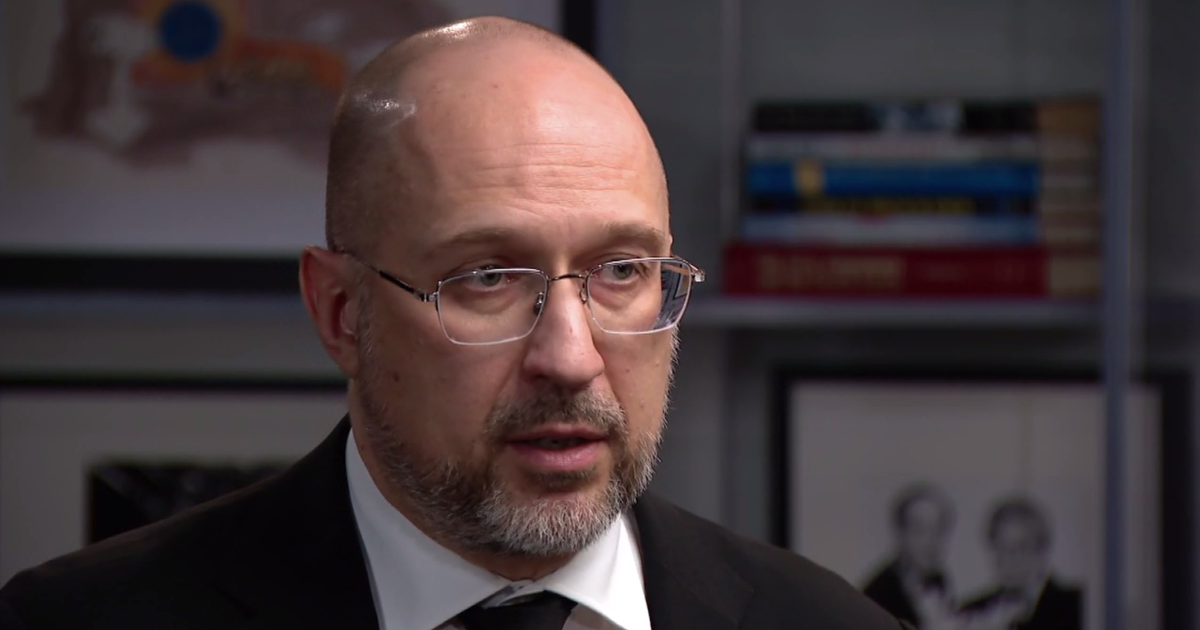

CBS 2 Morning Insider Tim McNicholas continues a months-long investigation into big banks and fraud victims.

Checking the mail is no simple task for Leskiw. She bikes to a post office, because she's worried someone might be stealing from her home's mailbox.

"I come here to get my mail now at a PO Box," she said.

Her concerns started in October, when she ordered a zero-interest credit card from HSBC. She never got the card, but she did get a fraud alert.

"So I called right away, and it turned out the card had been maxed out; beyond maxed out," she said.

Whoever had the card used it to spend thousands of dollars at multiple Sam's Club locations.

The good news? HSBC's website states "you won't be held liable for transactions you haven't authorized." So the bank refunded Leskiw's money, but then she heard from them again.

"They said, because the card had been activated through their automated system, that I would be held liable; and I don't know who used the card, or how it was activated," she said.

The transactions happened in Addison, Des Plaines, and Oak Park – all on the same day. But Leskiw said she doesn't even own a car, and rarely leaves the city of Chicago.

"Now they are charging me late fees on those fraudulent charges. All I wanted was a backup plan so I could buy a Christmas present for my niece," she said.

Leskiw filed a police report in Chicago, but HSBC told her in a letter last month they won't reopen their investigation unless she files a police report where the purchases were made.

"It seemed like nobody was interested in solving the problem. They just wanted me to pay for it. I don't have $6,000 to give HSBC," she said.

Federal law says, when it comes to fraud, the burden of proof is on the banks. But the Morning Insiders have uncovered multiple cases of victims doing their own detective work. Last fall, CBS 2 met a Bank of America customer who had to hire a computer expert to prove a hacker drained her funds.

"They said the claim had been denied, because it looked like the transactions had happened from one of my usual devices," Julie Poncela said.

After CBS 2 called her bank, they finally refunded her.

Sure enough, HSBC said they'd stop asking Leskiw for the $6,000 after CBS 2 reached out to the bank.

However, HSBC did not respond to multiple requests for an explanation why they were charging Leskiw in the first place, and how someone authorized her card.