Some Get It, Others Still Wait For COVID-19 Relief Funds: 'We Know The Need Is Great'

CHICAGO (CBS) -- Federal funds to help small businesses may have dried up, but the city of Chicago's relief program is only just beginning to approve emergency loans.

CBS 2's Vince Gerasole reports there still may not be enough aid to go around.

It is a large fund, $100 million, and in about two weeks the city has been able to process only 124 loans totaling about five million dollars. That would seem like a lot leftover, but the requests total in the thousands.

No one has checked in to the Wicker Park Inn for weeks, another business casualty of the coronavirus pandemic.

"It was a big hit for all of us to be at a standstill," Laura Yepez, owner of the Wicker Park Inn.

Just nine rooms, three furloughed employees and worry for Yepez, the owner.

"It's not glamorous. It's a lot of hard work," Yepez said.

And then...

"I was staring at the bills going 'oh my god how am I going to cover all of this?' And then I saw I had money in the bank to pay for everything," Yepez said.

Laura was among the first in the city to receive a low interest Chicago Resiliency Fund loan.

"It made a huge huge difference. I breathed a sigh of relief," Yepez said.

It's meant to throw small businesses a lifeline. The Chicago Resiliency Fund totals $100 million. The city has been able to approve 124 loans, of $50,000 or less, but over 8,000 have applied for the assistance.

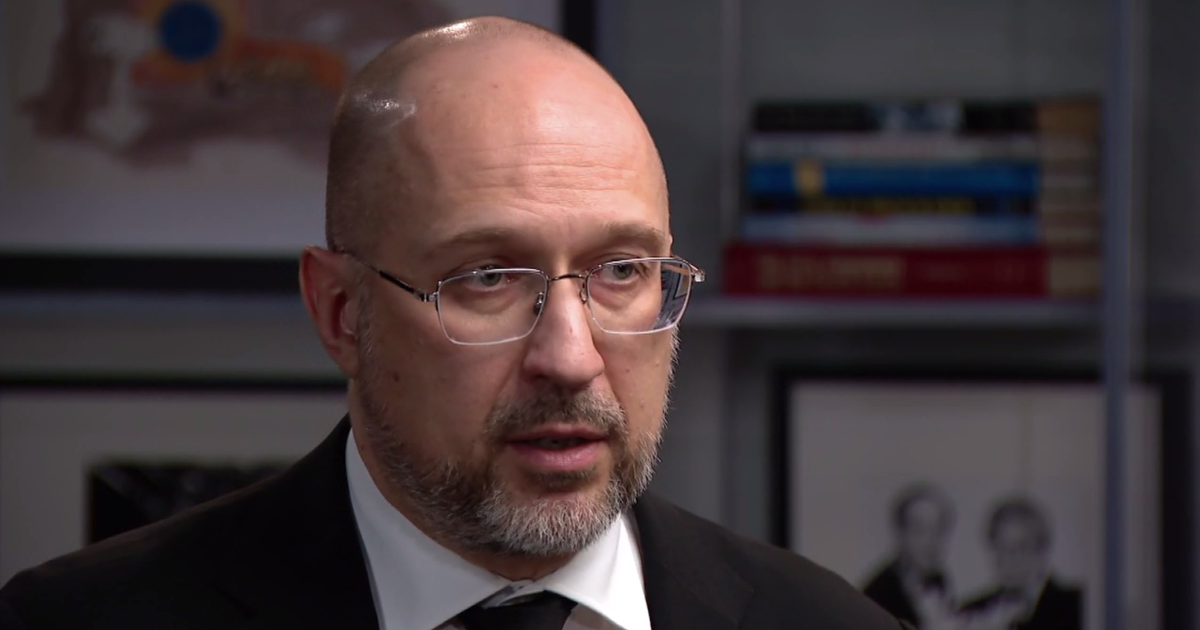

Rosa Escareno is the Commissioner of Chicago Business Affairs and Consumer Protection.

"The business community is hurting," Escareno said. "We know the need is great. The amount, $100 million is unprecedented. But we know the need is much greater."

Of the loans approved to date, two-thirds have gone to businesses with diverse ownership. More than 40% are businesses owned by African Americans or Hispanics.

"There's a first in, first out process," Escareno said. "But in that first in, first out, there is also consideration for the different geographies of the city."

So far, 67% of the loans have gone to low or moderate income neighborhoods. With so many businesses on the brink, Yepez knows she's lucky.

"In B and B, you do everything. The big benefit is I can bring my employees back," Yepez said. "And even though doors are closed, find productive ways to keep people busy and employed."

The city said it will work through the weekend to keep processing loans. The goal is to reach one approval every ten minutes. The city is asking business owners to be patient.

A lot of them have no other choice.

[wufoo username="cbslocalcorp" formhash="xkrloiw0xj564i" autoresize="true" height="685" header="show" ssl="true"]