Ads For And Against Illinois Graduated Income Tax Proposal Are Ubiquitious, So What's The Truth?

CHICAGO (CBS) -- We're being bombarded by them – ads for and against the graduated income tax proposal for Illinois that will be on the ballot next month.

So what is fact and what is fiction? CBS 2 Political Investigator Dana Kozlov spent the day sorting that out.

Regular people are sending two very different messages in ads for and against the proposed graduated income tax amendment. But what is the truth when it comes to the claims in those ads? Here is one of them in opposition:

"The tax hike amendment would increase taxes on over 100,000 small businesses, like ours, by nearly 50 percent."

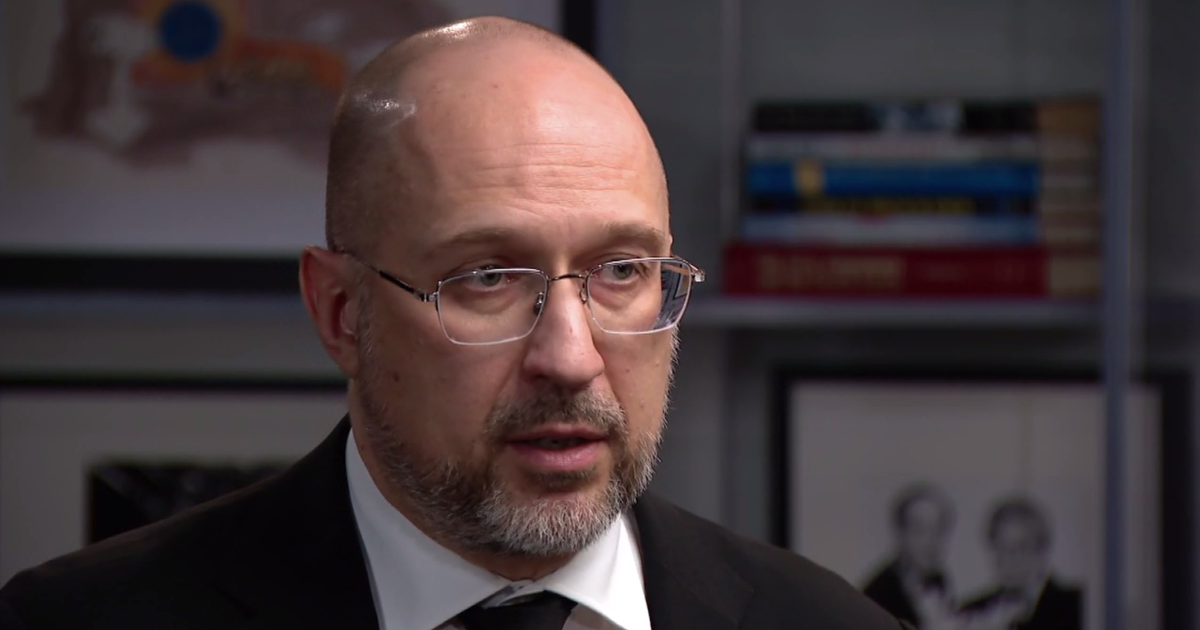

So we went to Laurence Msall of the Civic Federation, which is neither for nor against the tax proposal.

"The Civic Federation has concerns about how the tax would be applied," Msall said. "We also have concerns about how much money this tax may generate."

So let's start with claim of an increase in taxes on over 100,000 small businesses.

Msall's answer is that it's unclear.

"That requires more data than is generally available in order to understand who exactly is going to pay that," he said.

Another ad claims the graduated income tax will result in a tax cut for 97 millions of Illinoisans. Msall said that is true, but with one big caveat.

"I think the projections are that technically, 97 percent of those people will pay about the same – a 4.95 percent rate - or less," he said.

For most, he said, it would amount to 0.05 percent less.

And what about how income is taxed? The rate jumps 3 percent for those making more than $250,000, but only income above that $250,000 mark would be affected.

"You'll pay the higher rate for the first dollar over $250,000," Msall said.

Finally, taxing retirement income is another hot-button issue. Gov. JB Pritzker, who ran on getting the graduated income tax passed, said retirement income would not be taxed - but tax opponents say it could be.

Msall says no – both sides are, in effect, wrong. He said right now, if the Illinois General Assembly wanted to tax retirement income, it could take a vote on it and do so.

The price tag for advertising both for and against the graduated income tax has been steep. Gov. Pritzker himself has plowed more than $50 million of his own money into campaigning for the pro-side, while the anti-side campaign has also received tens of millions of dollars – most of it coming from businessman Ken Griffin.

The total price tag for campaigning on each side of the issue is about $100 million.