Now-Unemployed U.S. Census Managers Ordered To Pay Back Thousands In Social Security Taxes

CHICAGO (CBS) -- Imagine this – you're unemployed and you get a letter saying you owe thousands of dollars in back Social Security taxes.

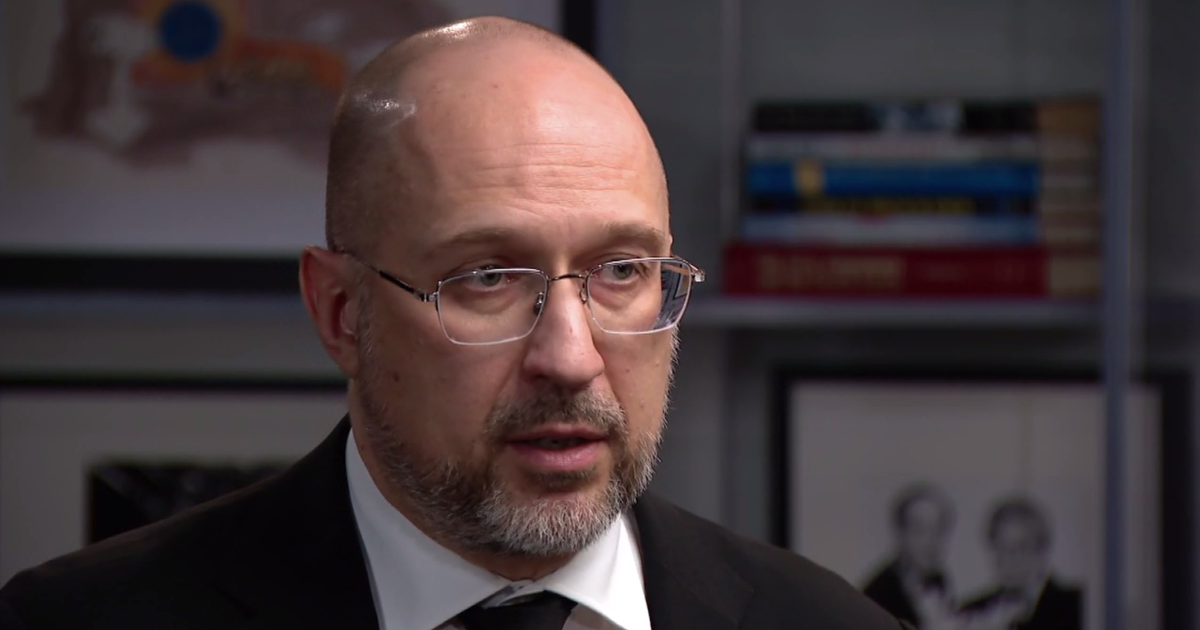

That is the reality for some local U.S. Census managers. CBS 2's Suzanne Le Mignot spoke to one of them, who said the news was a shock.

"I feel blindsided," the census manager said. "I feel like I've been sucker-punched."

This person was a manager at a Chicago area U.S. Census office. They recently received a letter demanding they pay deferred Social Security taxes.

In August of last year, President Donald Trump signed a memorandum allowing employers to defer certain workers' Social Security taxes during the COVID-19 pandemic.

"The demand letter came at the time that I would have already filed my taxes and received my return, which means that there was no opportunity for me to have my taxes amended, based on this debt," the census manager said.

After their work with the census was done, the employee was laid off.

"I am unemployed right now, and this debt is over $600," the census manager said. "I have to go into a payment plan, because we were - the letter is very threatening. If we don't pay it back, we're subject to the IRS - and I don't want that to happen."

An IRS spokesperson told us, those in this position can:

• apply for a payment plan;

• see if they qualify to settle their debt for less than the full amount,

• and request a temporary delay for collection, until their financial situation improves.

This U.S. Census employee and another we spoke told tell us they were never made aware they would be responsible for paying back money they don't have.

"I never received any documentation - any communication - from my former employer indicating that my payroll, Social Security taxes would be deferred while I was working," the Census manager said. "I think that this has a national impact. There are probably hundreds of thousands of managers that have been impacted by this nationwide."

We reached out to the U.S. Census for comment. They said they are working on a response.

how many federal employees are we talking about here?

Le Mignot also asked the IRS how many federal employees might be affected by the demand for deferred taxes, was referred to the office of personnel management for government employees - who then referred her to the Social Security Administration. She was waiting to hear back late Monday.