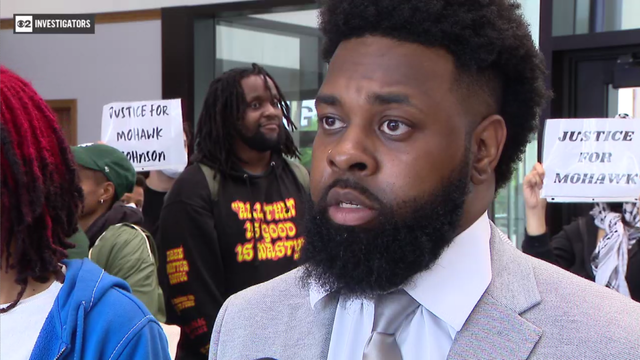

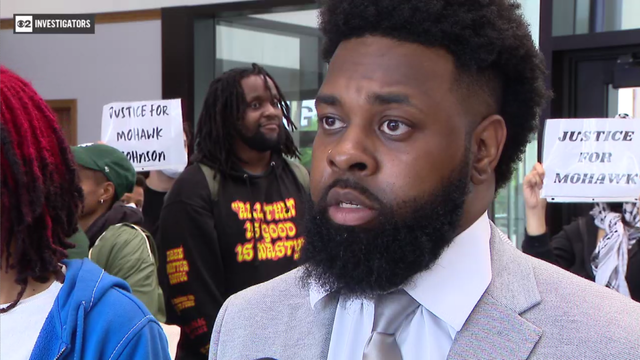

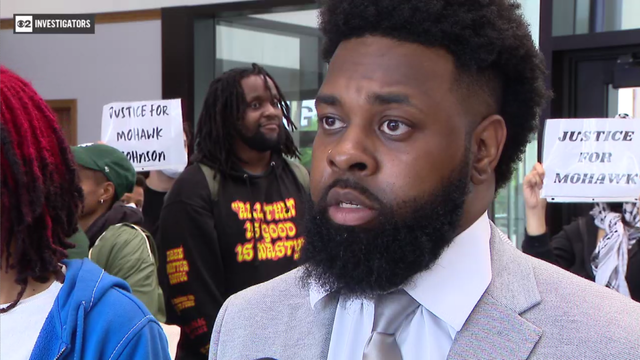

Chicago man accused of hitting officer during protest takes plea deal

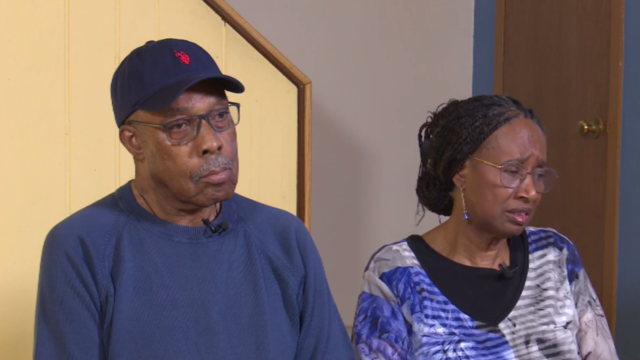

Jeremey "Mohawk" Johnson was able to avoid jail time because of his otherwise unblemished record and the enormous support of his community.

Watch CBS News

Jeremey "Mohawk" Johnson was able to avoid jail time because of his otherwise unblemished record and the enormous support of his community.

Prosecutors said there was a clear history of issues between the alleged shooter and his neighbor, a white woman who had two Black sons.

Ascension said it responded immediately, and access to some systems has been interrupted with remediation efforts in progress.

You deserve a treat. And this spring, Mother Nature is providing a seemingly endless supply – trillions of cicadas.

"Going through an experience like this where you lose a spouse is really a process of finding yourself again and figuring yourself out again."

"Artists on the South Side of Chicago need space to create, exhibit, rehearse, perform. And Sacred Places have those spaces in abundance that are affordable and other underutilized."

The Cats will now play the waiting game to find out where they're headed for next week's NCAA Tournament on Sunday at 6 p.m. for the NCAA Selection Show.

Lenore Carroll has been coming to the memorial service for years after she lost her father, a Joliet police officer, when she was only a little girl.

Offerings include traditional Filipino pastries such as señorita bread, hopia, and pandesal.

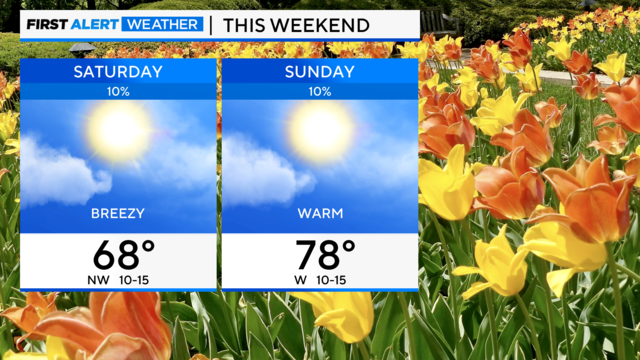

It will be a noticeably cooler day with breezy and wet conditions and highs near 60s.

CBS 2 News Chicago's weather forecast model — First Alert — helps digital users and traditional television viewers stay on top of Chicago's dynamic weather.

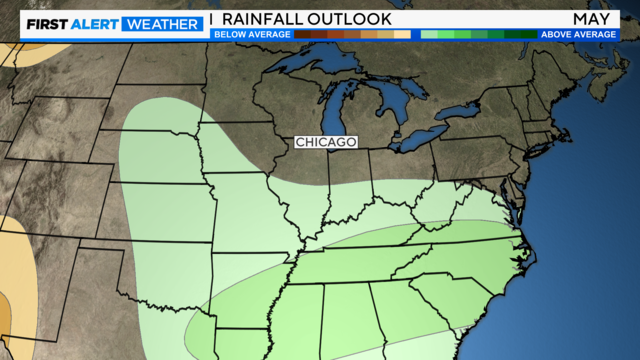

As the climate warms, May rainfall is getting heavier in Chicago.

Expert panel discussion centers the focus on the disparity that 1 in 3 victims of crime in Chicago is a Black woman

Police arrived at the scene sooner than if they had waited for the first 911 call.

Anthony Robinson's attorney said his previous defense lawyer failed to present evidence that showed it was physically impossible for him to be the shooter.

Ascension said once they noticed unusual activity in their network on Wednesday, they acted immediately. CBS 2’s Sabrina Franza reports.

Jeremey “Mohawk” Johnson was charged with hitting a Chicago Police officer with a skateboard during a protest downtown in 2020. CBS 2 Investigator Megan Hickey reports.

CBS 2 Meteorologist David Yeomans has a check on the extended weekend forecast.

Women who are also widows share their stories through artwork, showing how they communicate their pain through photographs. CBS 2's Shardaa Gray has their inspiring story.

CBS 2 Meteorologist David Yeomans has a look at the extended forecast.

The Cats will now play the waiting game to find out where they're headed for next week's NCAA Tournament on Sunday at 6 p.m. for the NCAA Selection Show.

Chris Flexen pitched six sharp innings, Paul DeJong homered again and the Chicago White Sox avoided their seventh sweep this season by beating the Tampa Bay Rays 4-1.

The team's first three games will be on the road. But the team's many new faces were on display at Media Day.

Offerings include traditional Filipino pastries such as señorita bread, hopia, and pandesal.

Last year, Nanetta Dancy-Matthews took the leap and opened Vari's Southern Cuisine inside Bobby's Gaming in Hillside with recipes she learned from her grandmother.

Emily Dupree founded the group after her partner caught COVID at a concert, even after wearing a mask.

The university has said protesters sleeping in tents were given fair warning before the encampment was removed, but protesters said there was no such warning.

Astarte Washington was 15 years old when she suffered multiple broken bones after an unattended Chicago police car rolled over her.

Irene Chavez's family said police ignored her pleas to go to the hospital, even after she repeatedly told them she was a veteran suffering from PTSD.

There were only 15 days with measurable snow this past winter in Chicago, but a total of 7,745 vehicles got hauled off the streets.

The convention is taking place from Monday, Aug. 19, to Thursday, Aug. 22.

Alderpeople are looking to try to stop rogue towers from making thousands off drivers who thought they were signing their car away to someone they could trust.

Employees at dozens of now-closed Foxtrot Market and Dom's Kitchen stores, now jobless, wonder what comes next for them as their paychecks will soon end.

The family didn't get their cut of the estate sale, not hearing back from the salesman until CBS 2 got involved.

The Better Business Bureau warns that anyone buying an event ticket should watch out for fake ticket scams.

Financial records show Paul Croft and J.D. Frost raised about $30 million for a hydrogen plant that was supposed to be, at one point, in Indiana. It never existed, an attorney says.

Researchers hope their findings will inspire action to make hearing aid devices more affordable since they can cost over $1,000 per ear.

First known HIV cases from a nonsterile injection for cosmetic reasons highlights the risk of unlicensed providers.

The city's measles dashboard said a total of 63 measles cases have been confirmed in Chicago this year, with one new case this week.

The department said anyone who visited the Sam's Club at 9400 S. Western Ave. in Evergreen Park one day last week may have been exposed to someone with measles.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Biden campaigned in the spot where Trump, to much fanfare, lauded a plan by Taiwan-based electronics giant Foxconn plan to build a $10 billion manufacturing facility that was supposed to eventually employ 10,000 people. Except it was never completed.

The Illinois Worker Adjustment and Retraining Notification (WARN) Act requires employers to notify workers of mass layoffs 60 days in advance.

Mayor Brandon Johnson denied that the Bears' shiny new dome could end up costing taxpayers a pretty penny.

Employees at dozens of now-closed Foxtrot Market and Dom's Kitchen stores, now jobless, wonder what comes next for them as their paychecks will soon end.

The company announced Tuesday that it received a stalking horse bid to purchase its operating assets.

This will be the first baby for Hailey and Justin Beiber, who announced their pregnancy after more than five years of marriage.

Brian Fox, a fellow producer and engineer at Albini's Electrical Audio studio in Chicago, confirmed Albini passed away Tuesday night from a heart attack.

For the past three months, a cast of 10 Asian American/Pacific Islander comedians has been working on the new program, "Youth in Asia (Are You Proud of Me Yet?)"

The stars came out for the the 2024 Met Gala in New York City. See some of the most eye-catching outfits of the night.

'Bob Hearts Abishola', the acclaimed comedy, is signing off after its fifth season on CBS.

Ascension said once they noticed unusual activity in their network on Wednesday, they acted immediately. CBS 2’s Sabrina Franza reports.

Jeremey “Mohawk” Johnson was charged with hitting a Chicago Police officer with a skateboard during a protest downtown in 2020. CBS 2 Investigator Megan Hickey reports.

CBS 2 Meteorologist David Yeomans has a check on the extended weekend forecast.

Women who are also widows share their stories through artwork, showing how they communicate their pain through photographs. CBS 2's Shardaa Gray has their inspiring story.

CBS 2 Meteorologist David Yeomans has a look at the extended forecast.

Jeremey "Mohawk" Johnson was able to avoid jail time because of his otherwise unblemished record and the enormous support of his community.

Prosecutors said there was a clear history of issues between the alleged shooter and his neighbor, a white woman who had two Black sons.

Ascension said it responded immediately, and access to some systems has been interrupted with remediation efforts in progress.

You deserve a treat. And this spring, Mother Nature is providing a seemingly endless supply – trillions of cicadas.

"Going through an experience like this where you lose a spouse is really a process of finding yourself again and figuring yourself out again."

Expert panel discussion centers the focus on the disparity that 1 in 3 victims of crime in Chicago is a Black woman

Police arrived at the scene sooner than if they had waited for the first 911 call.

Anthony Robinson's attorney said his previous defense lawyer failed to present evidence that showed it was physically impossible for him to be the shooter.

The village board is working on a resolution to hire Lightfoot, a former federal prosecutor before her lone term as Chicago's mayor, to investigate claims Henyard has been misusing public funds.

DCFS Director Heidi Mueller was asked Thursday why some kids in the system are being held in psychiatric hospitals longer than medically necessary.

The Cats will now play the waiting game to find out where they're headed for next week's NCAA Tournament on Sunday at 6 p.m. for the NCAA Selection Show.

Chris Flexen pitched six sharp innings, Paul DeJong homered again and the Chicago White Sox avoided their seventh sweep this season by beating the Tampa Bay Rays 4-1.

The team's first three games will be on the road. But the team's many new faces were on display at Media Day.

Dylan Cease struck out 12 and combined with two relievers on a one-hitter, and the San Diego Padres beat the Chicago Cubs 3-0.

The Wildcats went 19-3 in Big Ten contests and won all eight conference series for a second-straight year.

Prosecutors said there was a clear history of issues between the alleged shooter and his neighbor, a white woman who had two Black sons.

Guillermo Caballero's family said he got trapped inside a chaotic circle of cars and people at the illegal meetup – and was unable to escape.

A car riddled with bullet holes was spotted at the scene.

Police said a woman caught a 13-year-old girl and a 14-year-old boy trying to steal her, when the woman shot the girl in the shoulder.

Business owners believe the same crew might be involved in several other incidents.